Markets have apparently been speculating that the Fed will begin to taper quantitative easing (QE) sometime sooner than was previously anticipated. (See:

Stocks plunge as Fed minutes hint at cutback for more detail.) What bothers me is that a lot of people don't really seem to understand what the result of Fed tapering will be. So, let's see if we can work this out.

When the Fed sets the

Fed Funds Rate, it typically uses open market operations to manipulate short-term interest rates. Basically, when the Fed wants to lower interest rates, it buys treasury bills to lower the yield on short-term government borrowings. Because banks are limited in what they can do with excess cash, a lower yield on T-bills makes overnight loaning to other banks more attractive, and banks will be more willing to loan to other banks when the alternative (T-bills) offer a lower yield. In this case, the T-bill rate is the driver behind the Fed Funds Rate.

In theory, all other things equal, if the Fed lowers the yield on T-bills, the yield on longer-term government borrowings will follow, so the Fed doesn't normally get involved with those. But in the wake of the last recession, the Fed, for multiple reasons, decided that long-term rates (especially mortgage rates) weren't falling enough to spur growth. So, they decided to take a more direct approach, purchasing long-term treasury bonds, which have a more direct effect on mortgage rates. As near as I can tell, this isn't the official explanation for QE, but it's the one that I think explains the reason for QE best, and certainly does actually address the effect of QE. Forget about money supply; it's about interest rates.

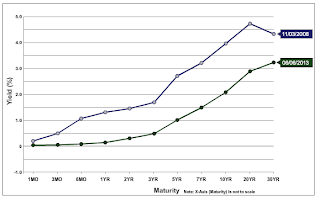

Generally speaking, then, the effect of QE is to flatten the

yield curve. Has it worked? You tell me. Here is a chart of showing the Treasury Yield Curve currently, as well as in November of 2008, before QE1. (

Source)

Yes it has, because the green line isn't as steep as the blue line. And one effect is that we've seen historically low mortgage rates, rates that we'll likely not see again in any of our lifetimes. Low mortgage rates help to pave the way to stabilizing the real estate market, and, in my opinion, the latest QE has done that a little too well.

But the point of this post is not so much what's happening in the markets now, but what to expect when the inevitable end of QE comes. The recent market reaction to rumors about the Fed maybe tapering earlier than expected shows a high level of uncertainty. Pretty much, every asset class dropped, indicating there must have been a substantial move into cash. Why cash? Because the value of cash is not dependent on interest rates at all, but nearly every other investment in the world is. Even gold.

Now, I know there are some people thinking that what I just said about the value of cash not being dependent on interest rates is just plain wrong, and that the end of QE will make cash more valuable. All other things equal, it will, but not because of the interest rates; it will be because of the difference in the supply of money. Other countries have turned on their printing presses as well, and if one stops, it will likely see an increase in the value of its currency as the supply of other currencies relative to that one currency grows. At least in the short-run. Longer term, there are other factors that will affect the value of the currency, but interest rates just isn't one of them. As usual, that's my opinion, based on the current workings of the global monetary system. Things change, though, and I could change that opinion at any time.

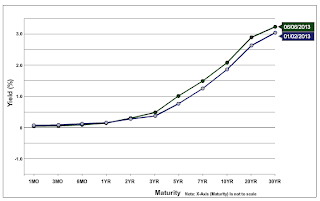

Okay, back to the topic at hand: the effect of ending QE. The first thing we should see is a steepening of the yield curve, and we can check that out using the same graphing utility on the Treasury's web site.

This time, I figured the beginning of the year as being as good a starting point as any, and as we can see, this time the blue line (January) is less steep than the green line (Current). Why? Because of speculation that the end is nearer than investors thought it was in January. (Almost) Nobody wants to be holding those long bonds when the Fed stops buying. This chart also shows something which is vital to a discussion of the effect of ending QE: rates under 2 years hardly budged. So, here we've found evidence that when people say interest rates are going to sky rocket with the end of QE are misstating what will actually happen. Some interest rates will likely increase, but not all interest rates. In other words, the yield curve will get steeper.

So what. Right? It is a kind of big deal depending on what investments you have in your portfolio. If you are invested in companies with little or no debt, then the impact should be minimal. However, there will be some slight decline as the risk premium rises (and perhaps whatever proxy for the risk-free rate investors are using). But for most companies with little debt, there should be no major impact on that company's results. For companies with a lot of debt on their balance sheet, it could be another story though. It really depends on how each company's debt is structured. If a company has a lot of long-term fixed rate debt, then it shouldn't be impacted as much because it has a low rate locked in. Maybe. Sometimes companies issue "putable" bonds to get a lower rate. These, of course, are not safe against interest rate increases.

One of the things that makes me believe that people in general don't understand QE is the volume of articles, blog posts, and comments that QE is somehow a way of bailing banks out, or making life easier for banks. There may be ways for banks to "game" QE that I'm unaware of, but generally speaking, QE is actually makes life harder for banks. The reason is clear when you consider that banks generally borrow short-term funds and loan long term, pocketing the difference in rates. A steep yield curve benefits banks because the spread is bigger, similar to a store that can raise prices while their cost remains the same can increase gross margin.

But, and there's always a but isn't there, the end of QE might not be that great for all banks (or other financial institutions that make money in similar ways). It's possible that the loans (or investments) made by the bank will lose value, making their collateral worth less and forcing the bank to pay higher interest, or perhaps issue more stock, or... well, lots of bad stuff can happen. If the loans a bank makes are fixed rate, then the value of those loans will fall; but if the loans are variable, then the value should stay the same because the borrower will have to pay a higher interest rate. However, this may not be true; if the variable rate loan has a floor (minimum) rate, and the borrower is currently paying the "floor" rate, then even if rates go up, the borrower may not be required to make higher payments, and so, the value of that loan will still decline.

Hopefully, this gives you some kind of idea of the complexity surrounding QE and its end. Because of this complexity, I've decided to start writing a series of articles that I'll publish on

Seeking Alpha covering a variety of types of financial institutions. In case anyone was wondering, this is what I've been working on lately and the reason I'm posting less frequently.